If the success of a Life Science event were measured solely by how many branded foam brains we handed out to undergrads passing our stands, our ROI would be extraordinary. Around 90% of marketers say events help their company stand out, and 89% say events are critical for business growth [1] [2], which shows why it’s time to move beyond superficial measures like badge scans.

There are some really important tactics that Life Science marketers need to deploy well and consistently to help generate healthy ROI from industry events. Some get missed because of time, resource or other constraints. In this article we cover issues such as gathering data that matters to your business, staffing your booth and planning, so that your event ROI conversations with leadership are more confident and meaningful to the business.

So what are we looking for?

Before deciding what to do on the stand, marketers need to be clear on their commercial objectives because events are not just a branding channel- they are a core business driver, yet research shows we are still some way from where we need to be. Cvent’s 2025 Outlook on Events [1] found that 41% of marketers struggled to measure ROI and create competitive events in 2024, highlighting how difficult it remains to track meaningful progress towards revenue.

Since the Harvard Business Review published The Event Marketing Evolution in 2019 [3], the industry has been urged to move beyond vanity metrics. Yet despite the COVID pandemic, major shifts in how customers research and buy, and rapid advances in technology, many organisations still find it hard to define and track the metrics that really matter. There is progress, but there is still work to do.

Before we beat ourselves up about attribution and metrics, let’s take a moment to acknowledge what we do well; where Life Science marketers lead the pack. Life Science marketers are perhaps the most sophisticated ‘value exchangers’ in B2B. We educate, we don’t just sell. We understand the value of using key opinion leaders, highly technical posters and peer reviewed data to help drive engagement and trust. We are already experts at generating high intent interest, but the goal is to get better at documenting it.

Defining tangible ROI: the KPI framework (and the data that makes it real)

The main metric we need to move away from is ‘badge-scan’ volume. It is far too simplistic, and in isolation it tells us almost nothing about commercial impact. Imagine your badge scans as samples in a laboratory freezer. You might be able to show leadership a freezer full of 500 vials, but if you haven’t recorded concentration, purity, or metadata, you don’t have a usable library; you just have an expensive collection of ice.

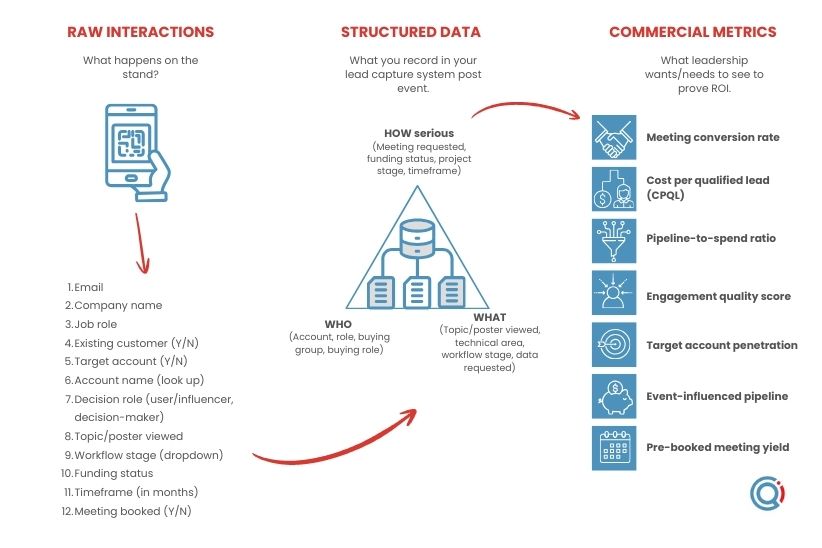

To measure real event ROI, we need to capture not just who someone is, but what they care about and how close they are to buying. That requires structured data fields, captured on the stand and synced directly into your CRM, rather than generic post-show CSV files.

The table below shows the KPIs that matter for Life Science events, the information that needs to be captured on the booth to calculate them, and where that data typically lives in a CRM such as Salesforce.

| KPI | Life sciences definition | What must be captured on the stand | Where it lives in CRM |

| Cost Per Qualified Lead (CPQL) | Total event cost divided by Tier A and Tier B leads only. | Decision role (user, influencer, decision-maker), funding status, buying timeframe. | Lead record and Campaign Member fields (Lead Tier, Timeframe, Funding). |

| Meeting Conversion Rate | Percentage of booth leads that convert into a technical discovery call within 14 days. | Whether a meeting was requested or booked during the event. | Activities (Meetings) and Campaign Member Status. |

| Pre-Booked Meeting Yield | Percentage of scheduled sales meetings that progressed to a qualified opportunity after the event. | Meeting ID, account name, buying group present, meeting outcome. | Activities linked to Accounts and Opportunities. |

| Engagement Quality Score | Percentage of leads who engaged with technical content rather than only scanning for giveaways. | Poster or topic viewed, data sheets requested, workflow discussed. | Campaign Member custom fields (Topic, Workflow Stage). |

| Pipeline-to-Spend Ratio | Total potential contract value of discovery-phase opportunities compared with booth cost. | Opportunity ID (for existing pipeline), estimated deal size, project stage. | Opportunities linked to the Event Campaign (Opportunity Influence). |

| Target Account Penetration | Number of new stakeholders engaged within your top target pharma or biotech accounts. | Account name, job role, buying group. | Accounts, Contacts and Campaign Members. |

| Event-Influenced Pipeline | Existing CRM opportunities that moved to a later stage after a booth interaction. | Opportunity ID, meeting logged, follow-up action. | Opportunities and Campaign Influence reporting. |

It is important to be clear about what this means in practice. A badge scan will typically give you a name, an email address, a company and a job title. That data supports footfall reporting and cost per scan. It does not support CPQL, pipeline, account penetration or deal acceleration.

Every commercial KPI in the table above requires structured intent data, captured in dropdowns and look-ups on the stand and synchronised directly into your CRM. When that data is there, leadership will be able to see not just how busy the booth was, but how much real revenue potential it helped to create.

Accurate on-site information gathering strategy

Naturally, in an industry where discoveries take years, we have developed a dangerous patience for slow data. We tend to treat the trade show floor like a scientific mixer, assuming that good conversations will eventually lead to good business.

But there is a silent ROI killer at work here, lead decay. Lead capture vendors such as iCapture [3] show that moving to a real-time, CRM-connected app can cut follow-up time from weeks to minutes by removing the dependency on generic post-show CSV files. This is not a minor efficiency gain, it is a survival tactic. In 2025, competition for a Principal Investigator’s (PI) attention is so intense that if your ‘thank you’ email arrives four days after the show, you are not just late, you are already forgotten. In our previous article we highlighted the research that shows when leads are contacted within 24-48 hours, they are 60% more likely to convert.

Standard versus bespoke data capture tech

The choice between a standard event app or badge scanner and a customisable lead capture platform is one of the biggest levers you can pull to improve trade show data quality. It might seem like a small operational decision, but it is one of the most important pieces of equipment your team will use on the floor. A customisable lead capture app allows you to record fields such as funding status, current workflows, time until trial, clinical phase and decision-making authority. That means your leads are available faster and already enriched with context that makes follow-up more personal and accurate.

These platforms range widely in cost. Enterprise solutions typically start in the region of several thousand pounds per year depending on contract size and integration needs, while lighter subscription or per-event tools can cost a few hundred pounds per event or month. In contrast, a standard badge scanner may look cheaper upfront, but it often leaves you waiting days for a generic data export with very little of the context your sales team actually needs.

Data capture with efficient follow-ups in mind

In the absence of an app customised to your data gathering requirements, provide your conference team with enough competitor, industry, sector and technical product knowledge, to help them triage leads. For example, you can use the BANT (Budget, Authority, Need, Timing) frame work or funding status, as additional data points to capture about the leads for greater context. This will help you allocate the right leads to the most relevant teams/reps for efficient follow- up.

Using the funnel to allocate floor resources

Using a well-accepted model of the typical decision-making process most humans go through, we can identify distinct informational needs in each stage. Those are typically:

- Interest

- Evaluation

- Consideration

- Decision/purchase

- Post-purchase

- Retention/advocacy

Although not in a linear way, most individuals with a need for a product or a service and attending a trade show, will likely be at any of the stages 1 – 4. These are the customers your teams needs to be most cognisant of first and foremost because they represent net new revenue potential. Of course, individuals who are already your customers (stages 5-6) will also likely be there, and they must not be forgotten. They can represent a ‘low hanging fruit’ opportunity to upsell, to manage reputation, and to provide referrals. These customers are already valuable to your business, and can continue to be if they are managed and acknowledged appropriately.

Advanced staffing and smart resource positioning is what will make the difference in capturing the attention of both your new and existing customers in the way that feels like a positive experience for them. When planning stand resources, it’s important to balance the right presence of technical expertise, ‘self serve’ information points, interactivity/participation without pressure, and make space for ‘swag tourists’ too. Sometimes this is done well, but when rushed, this kind of planning is often skipped reducing the quality of the overall experience for your stand visitors.

Your Tiger team

The biggest jeopardy, however, isn’t the technology, it’s the resource waste. If you haven’t defined roles clearly, your most expensive technical staff are at risk of being held “scientific hostage.”

Imagine your Senior Scientist, who costs a significant amount to be on that floor, spending 40 minutes debating molecular weight with a student who just wanted a free pen. That isn’t just a ‘nice chat’; it’s a hole in your pocket. For every 20 minutes your expert spends with a non-buyer, you are missing a Target Account stakeholder who walked by, saw the booth was ‘full,’ and didn’t stop.

To avoid this trap, consider the following structure for your trade show Tiger team.

The Greeter: he/she will need to be skilled enough in rapport building to be able to attract attention – discerning and product capable enough to know what questions to ask before passing them to either of the other two booth members or filtering out timewasters. They will also need to be sales cycle aware to understand the quality of the potential interaction – are they speaking to a potential decision maker? Are they browsing or do they have a problem/technical question that needs resolving?

The SME: he/she will need to be technically knowledgeable in whatever is being exhibited (e.g. instrumentation) but remember that your technical staff also need to be commercially minded. Ensure they are properly trained and prepared for such interactions.

The Closer: he/she is the bridge to the pipeline, so considering someone who has:

- High CRM discipline

- Great commercial awareness (knowledge of key target accounts, what they’re currently working on and technical enough to be able to take on the latter part of the SME discussion).

Having a Closer on your trade show floor team will not only mean that your business will receive vital target account intelligence, but should an existing customer come to your stand, they will feel seen, understood and likely feel they are receiving good customer service.

If you don’t have defined roles (and your team is carefully selected), you run a high risk of seeing your technical and closing staff spending their entire days with timewasters, whilst your greeters are lost in technical conversations that erode credibility through no fault of their own. This strategy is vital.

Capturing scientific intent

As discussed earlier, context is everything in Life Sciences demand generation and sales. Yet most people are understandably cautious about sharing their contact details, especially in an industry where key stakeholders are highly protective of their data.

The solution is a simple one. Information in exchange for information.

Scientists are driven by progress. They want to move their work forward, solve technical problems and reach their research or development goals. If your organisation can offer something genuinely useful in that pursuit, they are far more willing to engage. This is why so much of Life Sciences marketing focuses on trusted, peer-reviewed content rather than overt promotion.

At events, there are several effective ways to capture both interest and contact details while delivering real value.

Tip 1: A 30-second digital workflow audit

Offer a short, digitally captured workflow audit, perhaps incentivised with a coffee voucher or small item of swag. This allows you to understand context and identify bottlenecks in a visitor’s assay, process or workflow. You can then follow up with relevant application notes and technical documents that address their specific challenges.

Crucially, the audit also gives you insight into decision-making authority, project stage and urgency, which helps qualify the lead. Before the event, prepare questions that map to the first three stages of the buying funnel:

- Early interest: Research goals such as target protein yields, purification levels and titres.

- Evaluation: Hardware and process constraints such as throughput, processing time and number of touchpoints.

- Consideration: Integration and regulatory needs, including 21 CFR Part 11 compliance, closed system requirements and compatibility with other workflow tools.

Tip 2: QR code posters and digital poster galleries

Scientists love technical posters, but printed brochures quickly become a burden. A QR-based poster lets visitors scan, enter their details and view the content on their phone. Each scan records who they are and what topic they engaged with.

This means someone who scans a purification poster is tagged differently from someone interested in compliance or analytics. Follow-up can then be tailored with the most relevant application notes and data, turning casual browsing into clear, usable scientific intent.

The accountability phase: closing the loop

ROI is an acronym that is weighted with connotations of cost, accountability and justification. What science marketers want to be able to do, not only for the rest of the C suite but for themselves, is to review their efforts and activities with as great a degree of certainty as possible and to see proof that they have generated value for the business. The practice of analysing trade show ROI needs to be an ‘always on’ mechanism to help marketing and sales make progress and improvements. The biggest potential pit to fall into is disordered, non-consistent, and lazy lead capture. When data isn’t there, it is hard to prove through the ROI figures that what we do at events, and how much we invest in them, is justified.

Back at the office: the intelligence handoff

Once the event is over, the real value appears in how the data is used. Leads are tiered and routed based on what was captured on the stand, with high-intent opportunities followed up immediately and lower-intent leads placed into targeted nurture streams.

At the same time, marketing gains clear insight into market sentiment. Workflow audits, poster scans and conversations show where common pain points sit and which parts of the portfolio attracted the strongest interest. This helps shape future content, account plans and event selection.

Instead of a collection of badge scans, you are left with usable intelligence that supports both revenue and strategic decision-making.

A market research goldmine

During a trade show is one of the only times you will have hundreds if not thousands of researchers in one room. And that matters because a majority of marketers link events to a large share of closed business and faster deal velocity [1], making them too valuable to treat simply as networking or lead collection exercises. Remember that this is also an absolutely prime time to test your value proposition and map the market- not just to exchange pens for email addresses.

Time is precious to us all, especially marketers, who often have more hats to wear than the world has hat-stands. Taking the time to prepare for trade shows will ensure that you maximise taking advantage of opportunities presented only by the special nature of face-to-face events. Likewise, taking time to review what went well and what didn’t, to process leads and to follow up is critical. It’s time-consuming, without doubt, it costs most Life Sciences companies well over 50% of their total annual marketing budgets, it may require additional external resources too, but it is all part of making sure that your events ROI is fully-defensible.

The next blog in this series will explore building effective post-even follow-up nurtures, so stay tuned for more actionable tips, strategy and tactics for science marketers who want to unlock more ROI from trade shows.

Need help with warming and nurturing your trade show leads? Email us to see how quickly we can build a plan and a nurture that will transform your post-event strategy: hello@qincade.com

References

- Splash (a Cvent company), 2025 Outlook on Events, press release and summary of findings on event ROI and measurement challenges. [https://www.cvent.com/en/press-release/splashs-2025-outlook-events-88-marketers-identify-events-key-revenue-driver]

- Splash, 88% of Marketers Identify Events as a Key Revenue Driver. Summary of findings from the Outlook on Events research. [https://www.cvent.com/en/press-release/splashs-2025-outlook-events-88-marketers-identify-events-key-revenue-driver]

- Harvard Business Review Analytic Services, The Event Marketing Evolution: An Era of Data, Technology and Revenue Impact (2019). [https://hbr.org/resources/pdfs/comm/splash/TheEventMarketingEvolution.pdf]

- iCapture, Trade Show Lead Capture and Real-Time CRM Integration, iCapture resources and product documentation on real-time lead sync and follow-up speed. [https://www.icapture.com/capture-leads-trade-shows/]