Curiosity, specificity, and nuance are three vitally important traits in Life Sciences. It’s what leads to discoveries. It’s what helps researchers understand subtle variations in results and the context-dependent outcomes they observe in their work. But can the same be said for managing leads from trade shows?

Trade shows are a maligned medium for opportunity development. They have high capital outlay, and there’s a wealth of logistics, expense, and planning that go into executing an event. With every scribble into the chequebook, the inevitable steely-eyed stare of the ROI monster comes bearing down on events.

So why do we treat leads like business cards?

Don’t just take this blog’s word for it. Below we’ll look at both some industry-specific stats as well as some more general ones before we delve into potential strategies for lead nurturing.

Why precision matters: The ROI monster and the scientific standard

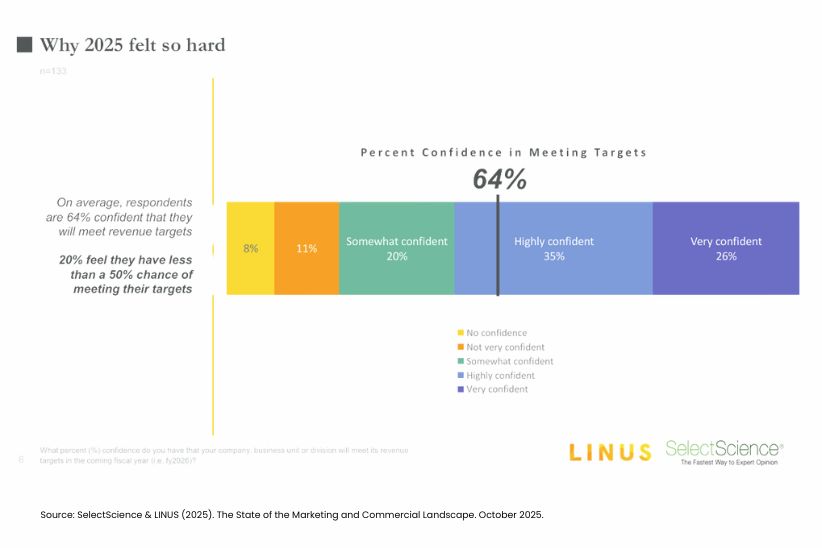

In a recent webinar with SelectScience and Linus in October 2025, market research conducted with both executives and researchers on the state of marketing and the commercial landscape found that, on average, only 64% of respondents were confident of hitting their targets. Not only that, but 20% of those surveyed felt that they had a less than 50% chance of hitting their targets.

With statistics like that, why would you leave capital on the table? Why would you not maximise every possible avenue for sales to drive confidence and, even more importantly, sales?

The reality is that trade shows are important across the board, not just in Life Sciences. As a marketing tool, trade shows are a place to not only expose your brand but also are a platform for sharing new technologies, for sharing ideas (as a speaker), and also for capturing vital information on the market: what your competitors are doing and what your customers are saying. Here though we are speaking about Life Science, and we can’t talk about specificity and go off on a generalised tangent, right? In the same report previously referenced, it was shown that trade shows (outside of peer-reviewed journals, word of mouth, webinars, vendor websites, etc.) are still a well-trusted source of information for respondents who were answering the question: ‘Where do you go for information/resources about laboratory products and technology?’

In summary, we have a trusted source for information for customers evaluating new technologies, a platform for brand visibility, and an environment to showcase innovations or conduct product demonstrations. So, where should all of these leads go after the event? Consider the other trusted sources of information highlighted, such as your website, technical notes, papers referencing the use of your tools in journals, webinars, independent websites, and so on. Not only that, but the follow-up, reliable efforts should be tailored to each individual, with the event being a catalyst to guide them towards the most reliable resources.

Where do they end up in reality? More often than not, the highly qualified leads are handed over to the sales teams, sometimes via badge scans, sometimes scribbled down, and the rest are added to generic follow-up marketing campaigns.

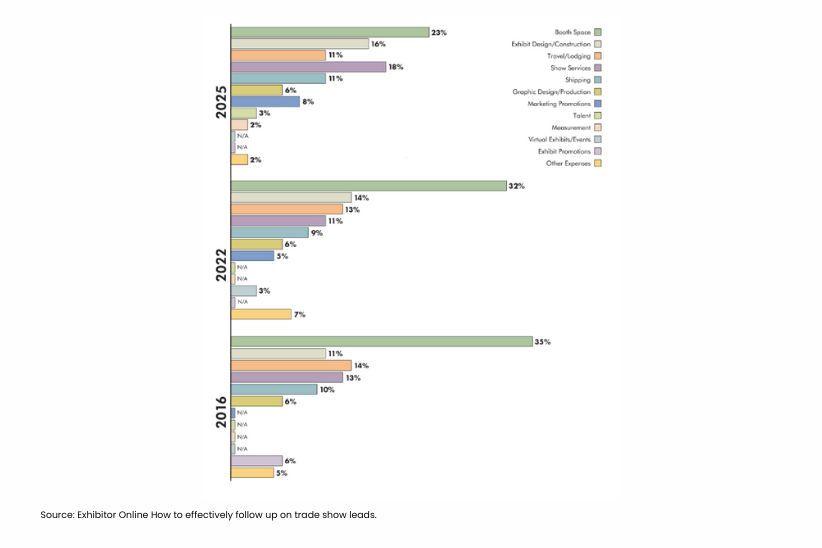

How can this happen? Well, it’s not just a Life Sciences industry issue. It’s a trade show matter, if you can call it that. Exhibitor Online surveyed over 200 event marketers [3] on how their budgets are currently being allocated. Alarmingly, when you look at the statistics on lead retrieval (as part of a wider catch-all ‘other expenses’ category), it was allocated at only 2% of the spend.

So let’s run through a scenario here; your ‘star buyer’ profile person walks on to the stand; as the Principal Investigator (PI) for a research group that’s just been awarded millions in funding, which they have the discretion to spend as they see fit. They’re launching a new company and building out their new lab. They are on the stand talking to your business development manager and an application scientist about a cell line challenge that’s critical to the success of their optimisation and scale-up process. There are also other areas where your team can help. The conversation flows but the only contact information captured is a name and email address from a basic scanner the venue provides which has limited functionality. The only follow-up your prospect receives post-event is a small ‘Thank you for visiting the booth’ email. Just like that, you’ve lost the context, perhaps even the lead and the personal experience the prospect had on the stand is completely different once it hits their inbox. They go from personalised, face-to-face experience to a generic message, leaving a sour taste.

Looking back at the stats, while the trend on spending more on promotions and show services is a good sign of a changing focus from vanity to quality, the minimal spend on lead capture suggests a general industry disconnect between the high event cost and the low priority given to effective lead follow-up.

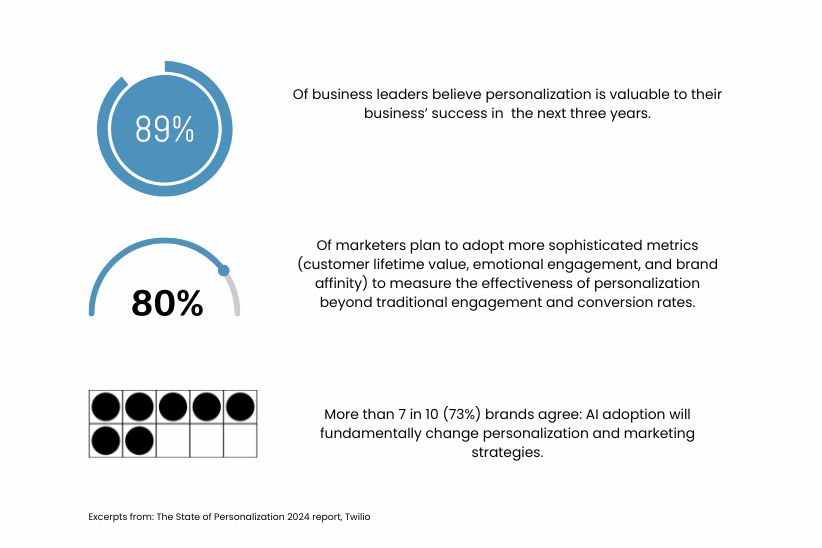

When you compare this general trend to both the move towards increased personalisation in 2026 identified in the SelectScience data [1], and similarly the trends seen in Twilio’s Segment 2024 report [2], which surveyed 500 business leaders across various countries and markets it was found that 89% of decision makers believe personalisation is invaluable and the case becomes very strong.

So what should you be considering in your lead nurturing strategy for trade shows?

The pre-show strategy: Warming up the leads

First off, the show doesn’t start on the day itself, you don’t need us to tell you that. But with all the logistics, travel, shipping, stand design, and so on, there are so many things that will already be on your plate, not to mention the pressure to make it a success. The point in emphasizing this is that the investment here makes all the difference.

Before the event, you will naturally aim to drive attention to it and here’s where a targeted approach can help.

At this point, ensure that you have a clear sense of the Ideal Customer Profiles (ICPs) that you aim to gather from the event, as leads. Review your CRM to identify which titles convert most frequently to SQLs, and investigate internally which roles typically make decisions or are influencers for the tools or services you offer. Collaborate with sales to develop this understanding; examine what has statistically worked for your teams and the stakeholders they usually engage with for current opportunities or successfully closed deals. Once this is clear, you can begin.

From a broader perspective before the show, implementing ads, social media engagement, website updates, and any other awareness-related campaigns about event attendance is vital. If you are displaying or demonstrating certain technologies that align with specific ICPs, then targeted outreach to those involved in related activities that could benefit their work may generate some pre-show interest. This could include a technical meeting slot for a specialised approach, perhaps having an application scientist explain a challenging skill, offer an exclusive content preview, a resource giveaway after taking part in a demo, or provide additional resources for a speaking session.

Focus your sales teams on arranging meetings or demos for the day on the stand. Footfall can be difficult to attract at events, due to attendees being wary of badge scans, the talks they have come to attend, and the numerous stands present. Having set times when attendees are actually at your stand can not only help sales secure that long awaited demo but also generate interest in the stand. From a nurturing perspective, you now have a prospect for a specific path with vital information.

Invest time in both selecting the right technology and the best approach for lead capture. The key to success lies in the detail, and that is especially true for data capture. In previous blogs we’ve discussed the importance for specificity in follow-up and nurturing, and the same applies here. To effectively nurture leads after a trade show, you need the right information from attendees. This involves training staff on relevant data capture technology that enables you to gather all necessary information to provide value during follow-up. In practice, this means training staff to record detail such as which instrument they interacted with, which brochures they picked up, and what techniques, technologies, or areas they are interested in, or work on e.g. proteomics, microscopy, upstream vector manufacture, etc. Focus on capturing details valuable to your business and marketing processes, and you’ll eventually benefit from better personalisation and higher closed-won rates.

Develop nurture paths for different ICPs before the trade show. After the event, follow up with ICPs. This might seem obvious, but a critical part of pre-event marketing is creating nurture paths, collating application notes, papers, technical specs, related webinars, and other materials that will be used in the post-event follow-up. Additionally, ensure you reflect the scientific context and buying cycle as much as possible, segmenting by role and decision-making power, scientific intent, the data you expect to collect from the badge scan, and the level of interaction during the show.

Generic drip campaigns may seem like a quick way to follow-up with the ‘not so hot’ leads, but they can also be a quick way to loose ROI. While some people attending the event might be closer to purchasing and seeking a product demo, there will also be those who are much earlier in their journey. Like all scientists, they want evidence and data before taking action. Similarly, Some might be interested in a demo but will have absolutely no decision-making power in buying an instrument- just a curious scientific mind.

There’s also a whole wealth of other things to do on the day, but that’s covered in our blog for getting the best ROI from events.

Post-show: Action in the first 72 hours

The event is over, sales are on their way back, and you and the team are in the office working on the next steps.

First, sales should follow up with the highest-potential leads within the first few days after the event. These are the contacts who visited your stand or, if available from the organizers, any badge scans or other data captures that include a clear call to action and align with the right ICP. Route these leads to sales as quickly as possible.

The follow-up doesn’t always need to be a qualification call, it can be a personalized follow-up aimed at each specific individual. Perhaps they wanted more technical information, so arranging a meeting with a Field Application Scientist would work well. Maybe they require more technical documentation, so send them relevant application notes and ensure they have any supporting materials. It could even be a gift from winning a competition on the stand. For sales, team members should make sure they have the appropriate content and follow-up resources to support their efforts.

Following up in the first few days is crucial, although we might say that…marketing and executives want to see quick results; but that’s not the main motivation here. We can look to a psychologist Hermann Ebbinghaus for evidence; his research on the ‘forgetting curve’ shows that 50% of new information is forgotten within the first hour. Within 24 hours, that increases to 70-80%, so it is understandable to forget names occasionally but more importantly, your prospect might not even remember you by the end of the week. Research from Intelemark [4] reveals that leads contacted within 24-48 hours are 60% more likely to convert. All of this underscores how critical timely follow up is.

Next come the slightly colder leads. Review the rest of the list, identify your ICPs from earlier, and filter them based on the information you’ve collected. This is where detailed prospect or delegate information details are vital. If you can gather more than just their name, job title, and contact information details such as their area of work, seniority, or technologies of interest will help with personalised outreach and setting them on the correct nurture pathway. For example, someone involved in AAV development might receive invites to webinars on the topic, papers discussing technology use or application notes. Likewise, a scientist focused on gene editing might receive information about CRISPR technologies, talks, webinars, and more. This approach prevents them from going cold completely.

Now we come to talk about the event content. If you’ve managed to obtain assets from the even such as talks delivered, videos of demos, summaries of Q&A sessions, or other resources; utilise these both broadly on your social media, emails, and other outreach efforts from a generalised perspective but also in follow-up communications with those specific ICPs from the events. Ensure that your commercial team/sales folk have access to these resources and incorporate them into drip campaigns, segmenting the content by relevance.

Execution and optimisation: omnichannel and analysis

Make sure that all channels are being utilised by sales and marketing. Omnichannel distribution is essential in Life Sciences. If you’ve ever had the privilege of cold calling scientists or researchers, you’ll find that they are unsurprisingly in the lab a lot of the time. Similarly, you might be emailing the same lead for months and finally connect with them on LinkedIn and receiving a message back within hours. Like many markets, there is no single path to connection, so ensure that sales use them all, and the same applies to marketing. Ensure websites are current, resource links are up, LinkedIn strategy and posts are written and scheduled.

You can hear the cacophony of sales staff criticising sales admin and metrics, where they have little time, and where specificity comes into play again. Segmenting data and focusing on ICPs will give sales the time to do proper follow-up with the right people rather than just analysing. The focus remains on the bottom line, and ROI is often measured in sales, so anything that optimises that process and helps avoid the trap of only targeting low-hanging fruit should be warmly welcomed.

Next, analyse the data. Monitoring the performance of your nurture paths, such as conversions to SQL or sales, email open rates, and which resources are downloaded and by whom, will show you what’s working and where to optimise. This insight helps you continuously improve your follow-up, assess the overall success of the event, and refine your ongoing lead-nurturing strategy.

On the latter point, this may be easier for smaller companies to manage in terms of lead volume, but it can quickly become unrealistic without sufficient resources. Larger organisations may have more capacity, yet often lack individuals with deep expertise in sophisticated, Life Science–specific lead-nurturing analytics. At this stage, you need to decide whether to invest in building this capability in-house or to partner with a specialist Life Science agency that already has the tools, industry insight, and proven experience in nurturing high-quality Life Science leads.

Now consider the former scenario… the strategy is sound but execution breaks down because the people responsible are already juggling multiple roles and lead follow-up becomes just another hat picked up at the stand. This internal resource gap is where ROI quietly erodes.

Ultimately, effective lead nurturing is a continuous experiment. By applying the scientific method of data analysis, segmentation, and dedicated resources you can turn trade show investment from a costly guess into a predictable engine for Life Science sales. Stop treating trade show delegates like business cards and start treating them like the high-value scientific opportunities they are.

Let’s talk about building a nurture program that finally matches your sophisticated science.

References

- SelectScience & LINUS (2025). The State of the Marketing and Commercial Landscape. October 2025.

- Twilio Segment (2024). State of Personalization Report 2024.

[https://www.twilio.com/en-us/resource-center/download/state-of-personalization-report] - Exhibitor Online How to effectively follow up on trade show leads.

[https://www.exhibitoronline.com/topics/article.asp?ID=3680] - Intelemark (2025) How to qualify, prioritise, and follow up on trade show leads for higher conversions.[https://www.intelemark.com/blog/how-to-qualify-prioritize-and-follow-up-trade-show-leads-for-higher-conversions/]